Cupons da EBooks.com para Mergers & Acquisitions

- Mergers & Acquisitions

- Accounting

- Advertising & Promotion

- Auditing

- Banks & Banking

- Bitcoin & Cryptocurrencies

- Bookkeeping

- Budgeting

- Business Communication

- Business Ethics

- Business Etiquette

- Business Law

- Business Mathematics

- Business Writing

- Careers

- Commerce

- Commercial Policy

- Conflict Resolution & Mediation

- Consulting

- Consumer Behavior

- Corporate & Business History

- Corporate Finance

- Corporate Governance

- Crowdfunding

- Customer Relations

- Decision-Making & Problem Solving

- Development

- Distribution

- Diversity & Inclusion

- E-Commerce

- Econometrics

- Economic Conditions

- Economic History

- Economics

- Education

- Entrepreneurship

- Environmental Economics

- Exports & Imports

- Facility Management

- Finance

- Forecasting

- Foreign Exchange

- Franchises

- Free Enterprise & Capitalism

- Freelance & Self-Employment

- Globalization

- Government & Business

- Green Business

- Home-Based Businesses

- Human Resources & Personnel Management

- Indigenous Economies

- Industrial Management

- Industries

- Inflation

- Information Management

- Infrastructure

- Insurance

- Interest

- International

- Investments & Securities

- Islamic Banking & Finance

- Knowledge Capital

- Labor

- Leadership

- Logistics & Supply Chain

- Mail Order

- Management

- Management Science

- Marketing

- Mentoring & Coaching

- Money & Monetary Policy

- Motivational

- Museum Administration & Museology

- Negotiating

- New Business Enterprises

- Nonprofit Organizations & Charities

- Office Automation

- Office Equipment & Supplies

- Office Management

- Operations Research

- Organizational Behavior

- Organizational Development

- Outsourcing

- Personal Finance

- Personal Success

- Production & Operations Management

- Project Management

- Public Finance

- Public Relations

- Purchasing & Buying

- Quality Control

- Real Estate

- Business Reference

- Research & Development

- Sales & Selling

- Secretarial Aids & Training

- Skills

- Small Business

- Statistics

- Strategic Planning

- Structural Adjustment

- Taxation

- Time Management

- Total Quality Management

- Training

- Urban & Regional

- Women in Business

- Workplace Culture

- Workplace Harassment & Discrimination

Cupons EBooks.com Mergers & Acquisitions, códigos promocionais e descontos Julho 2025

Descontos imperdíveis EBooks.com Mergers & Acquisitions

FAQ — Cupom de desconto da loja online EBooks.com

A loja da EBooks.com tem cupom de frete grátis?

A EBooks.com oferece frete grátis em pedidos selecionados, embora as especificações sobre elegibilidade possam variar. Geralmente, a loja oferece frete grátis para clientes que atendem a um requisito mínimo de compra, que geralmente é definido em um valor específico em dólares. Os clientes são incentivados a verificar o site para obter as promoções e termos mais atuais associados ao frete grátis, pois eles podem mudar dependendo de campanhas sazonais ou eventos especiais. Além disso, o frete grátis pode ser aplicado somente a certas categorias de produtos ou durante períodos promocionais, tornando essencial que os compradores se mantenham informados sobre as ofertas em andamento.

A loja online EBooks.com tem cupom de desconto na primeira compra?

Para novos clientes, a EBooks.com normalmente oferece um desconto na primeira compra. Esta iniciativa é projetada para incentivar novos usuários a explorar a vasta seleção disponível no site. Os termos deste desconto podem incluir uma porcentagem do total da compra ou um valor fixo em dólares, dependendo das promoções atuais. No entanto, é importante que os clientes revisem os critérios de elegibilidade específicos e quaisquer limitações que possam ser aplicadas, como exclusões em certos títulos ou um valor mínimo que deve ser gasto para se qualificar para o desconto.

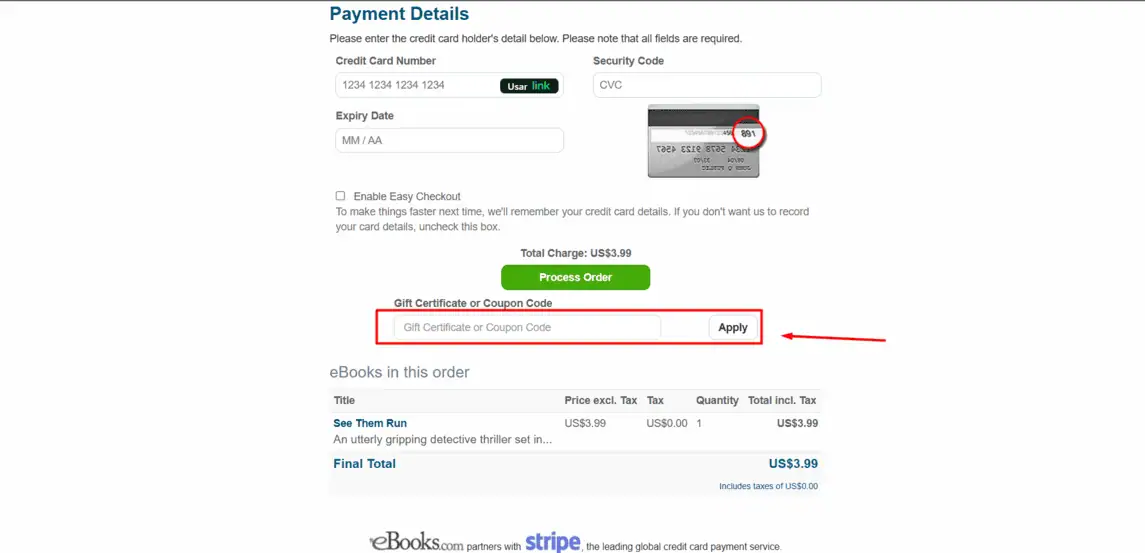

Como usar um código promocional na loja online EBooks.com?

Você sabia que usar um cupom da EBooks.com é muito fácil? Você só precisa seguir o passo a passo abaixo para aproveitar!

- Escolha o cupom que oferece o melhor desconto na Cashbe;

- Clique em “Abrir” e depois em “Copiar link”;

- Ao ser redirecionado à loja da EBooks.com basta adicionar os produtos no carrinho;

- Em seguida, finalize a compra e confirme o seu pedido;

- Adicione o código copiado no campo de cupom da loja da EBooks.com;

- Clique no botão “Aplicar” para o código ser aplicado ao pedido;

- Veja o valor final da compra diminuir e a finalize!

Onde inserir cupom de desconto EBooks.com

Incorpore Estratégias de Mergers & Acquisitions ao Seu Negócio

Pensando em negócios, já viu como algumas empresas conseguem unir forças e se tornarem verdadeiros gigantes do mercado? Esse é o mundo dos Mergers & Acquisitions, ou M&A para os mais íntimos. Imagine, num fim de tarde em SP, você se depara com uma notícia bombástica sobre duas grandes marcas se fundindo, aquelas que você jamais imaginou juntas. Essas estratégias têm o poder de transformar o cenário econômico, criar sinergias, e, mais importante, trazer novos horizontes para os negócios.

O ABC das Fusões e Aquisições

- Entender o Processo de Valorização

- Analisar os Benefícios das Sinergias

Entender o processo de valorização é essencial para quem deseja embarcar nesse universo de M&A. A avaliação cuidadosa do valor de uma empresa não é só olhar para o balanço financeiro, mas também considerar potenciais crescimentos e incorporações tecnológicas. É quase como descobrir o valor escondido em uma joia rara que precisa ser lapidada. Além disso, saber onde estão as verdadeiras "validades" do ativo pode mudar drasticamente a decisão final.

Quando falamos em sinergias, tudo ganha sentido ao analisarmos os benefícios que uma combinação bem feita pode trazer. Isso pode incluir tudo, desde aumento de lucro operacional até a otimização de recursos humanos e tecnológicos. As sinergias são como a orquestração perfeita, onde cada instrumento (ou componente) contribui harmonicamente para o sucesso da empreitada. E não é que o mercado fica de ouvidos atentos para essa melodia empresarial?

Planejamento Estratégico para Sucesso em M&A

- Identificar Parceiros Potenciais

- Gerenciar Riscos e Incertezas

Identificar parceiros potenciais é como procurar a peça perfeita para completar um quebra-cabeça complexo. As empresas que buscam M&A de forma estratégica olham para além das cifras. Elas procuram sinergias culturais, visão compatível e, claro, aquele "match" imbatível que só uma parceria bem feita pode oferecer. Quando as peças se encaixam, as possibilidades são infinitas.

O gerenciamento de riscos e incertezas muitas vezes é o que define o sucesso ou fracasso de uma fusão ou aquisição. Percepção aguçada e planos bem fundamentados são essenciais para mitigar os riscos e assegurar a continuidade pós-transação. Ninguém gosta de surpresas ruins, certo? E com um bom plano, os cenários adversos podem se tornar trampolins para novas oportunidades.

Se você está a bordo do mundo corporativo ou simplesmente curioso sobre como essas fusões excepcionais acontecem, os ebooks da categoria Mergers & Acquisitions são uma leitura e tanto. Aproveite os cupons disponíveis no site para liberar essas estratégias poderosas e, quem sabe, usá-las para alavancar sua própria carreira ou negócio. É hora de descobrir até onde a união de forças pode levar você!